-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

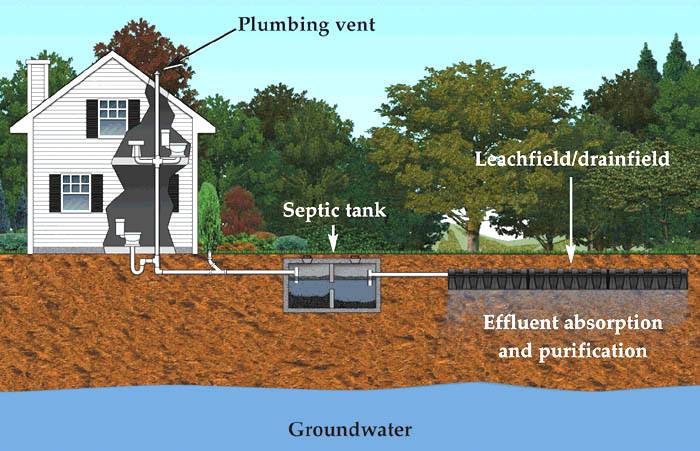

Minneapolis, MN: When buying a home that has a well or septic system, additional consideration are necessary in relation to the current conditions of the water well and the waste water septic system.

Needless to say, it is rather important that both of these systems are functioning properly and in good working condition, as repairs to these systems can very quickly become expensive. I personally have had both a well and septic system for over 25-years, so I can speak both from person experience, and from a lender perspective.

I strongly recommend all homebuyer demand the seller prove a third party certification of a properly functioning septic system, and a water test to determine the quality of the water, and if there is an contamination.

Lender Requirements for wells and septic systems

Some mortgage loan programs REQUIRE tests on these system before you can close on the home, while others do not. Here is a quick review of current popular program requirements:

Standard Conventional Loans

These hoe mortgage loans, backed by Fannie Mae and Freddie Mac do NOT require a mandatory well or septic test.

BUT, be aware, that there are cases when they WILL be required: That would be IF:

- The purchase agreement talks about potential issues

- The real estate agent, seller, inspector, or anyone else party to the transaction informs the lender of appraiser of any potential issues

- The appraisers notices any issues. For example, the appraisers sees septic discharge water in the yard.

FHA Mortgage Loans

FHA backed home mortgage loans ALWAYS REQUIRE both a well and septic test. Furthermore, the well and septic system must meet certain conditions. For example:

- The septic tank and the water supply must be at least 50 feet apart on existing homes, and at least 100 feet apart on new construction

- The well must be able to deliver at least 3 gallons of water per minute

VA Home Loans

VA homes loans generally do NOT require a septic system test, unless as noted under the conventional guidelines, a system problem is noted.

VA home loans ALWAYS will require a water test. See "water test requirements' below.

USDA Loans

USDA Rural Housing Loans follow FHA loan guidelines

Compliant Versus Non-Compliant Septic Systems

When doing a septic system certification, the system may comeback as failing, but the mortgage industry generally divides a 'failing' system into two categories. Failing compliant, failing non-compliant.

Failing Non-Compliant: This means the system, is totally failing right now and is not usable. This category always means the system MUST be repaired PRIOR to any loan closing. The exception being rehab loans, like an FHA 203k, but in this case, the failing septic system MUST be part of the repair work.

Failing Compliant: This typically means the system is currently functioning correctly, but is no longer compliant to current local septic guidelines. For example, when I bought my house, I fit this situation because the septic tanks were made of cement, and the current local code mandated the tanks be plastic.

Failing compliant system usually do NOT need to be repaired before closing, but local ordenence typically will require the new owner to update the system within a short time frame The most common I hear is within one year of closing.

Water Test Requirements

Water quality test guidelines usually say the water supply "must meet local health authority" guidelines, whatever that means. The most common tests are done for:

Find a local water testing company. When you select a water testing provider, make sure ALL OF the following items are included on your water test:

- LEAD (first draw)

- Nitrates (as Nitrogen)

- Nitrite (as Nitrogen)

- Total Nitrate/Nitrogen

- Total Cloriforms

- E-Coli (fecal coliforms)

- Arsenic

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.