-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

No one likes having bad credit, but sometimes it happens. Unfortunately bad credit hampers so many things in life, including obtaining a home mortgage loan.

Can I get a mortgage loan with bad credit?

Maybe... Depends on how 'bad' the bad it.

What credit score do I need to get a mortgage loan?

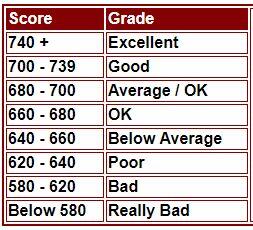

Any credit score under 640 makes it hard to get a home loan. The further below 640, the harder it gets.

Once your credit score falls below 580, I'm not saying you can't, but you have very low odds of getting an approval. My general advice, is if your score is below 580, you should probably and to work on improving your credit scores first.

Understanding Your Credit Score

Every mortgage company uses a mortgage credit report (this is different from Credit Karma, or your credit card statement) to determine your credit worthiness. All credit activity for the past 7-years is on your report. Good, bad, or otherwise. Foreclosures and bankruptcies show up for 10-years.

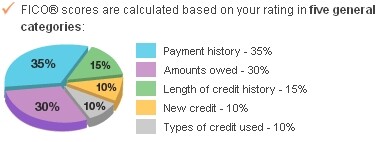

Obviously paying your obligations on time is important, and missing payments hurt your score. But there is much more than that factored into your score too. How much debt do you have, how long have you had credit, how many accounts do you have. Do you have different types of credit; say a car loan, home loan, and a few credit cards. Or do you just have credit cards?

Next, understand a lot of the credit isn't about you personally, but also about the population in general. If similar people with similar profiles tend to do similar things. You probably will too. For example, those who carry high average balances on credit cards tend to default at a much higher rate. Even if you've never been late on your credit cards, if you are carry high balances, it is assumed you will likely default, and you are given a lower credit score.

Click here for some general criteria used within the lending industry to determine credit.

What credit score do I need for a home loan?

Generally speaking, in today's mortgage world, if your middle credit score is below 640, you are going to have a very difficult time obtaining a home loan. I didn't say impossible, I said very difficult. The further below 640, the harder it will be. For example, a 620 might still make it for a conventional loan, but under 620, that option goes away.

If you are below a 580 credit score, it is almost impossible to qualify for home loan financing no matter what anyone tells you, or what you read on the internet. Again, I didn't say no, I said almost impossible. You would need at least 10% down payment, and maybe higher. If you don't have that, don't even bother trying. While many lenders and loan programs appear to take lower credit scores, understand that credit score alone does not get you approved. With scores that low, you usually have plenty of other things on your credit report that will get you denied regardless of score, like recent late payments, foreclosures, etc.

FACT: Credit score alone does NOT equal a loan approval

With a score below 580, you really should save yourself the hassle. Stop attempting to find mortgage loans, and work on improving your scores instead. Once you have achieved a 620 or higher score, you should be in much better shape. If you are denied by a one lender, contacting 10 more probably won't help.

How To Review Your Credit Score

If you are not sure what your credit score is, you should officially find out. You can do that by apply for the mortgage loan. We will pull your credit, and give you a review your exact situation. Another options is to obtain your credit report free from either www.AnnualCreditReport.com (no scores), www.CreditKarma.com (score), or WalletHub.com. Many credit card or other financial services also give you a free credit score each month on your statement.

[PRO TIP]: Understand that any 'free' or credit report YOU can obtain anywhere yourself DOES NOT provide you with the same credit scoring model used by most lenders. Therefore any score you are given will likely differ from the score any actual lender provides.This includes when you buy your credit score from the actual credit bureaus. These services are useful in giving you an idea of your credit score, but don't be surprised if a lender gives you a different score.

CREDIT PROBLEMS & ANSWERS

Basic Late Payments

If your credit has multiple RECENT 30, 60, or 90-day late payments, you probably won't qualify. Especially if those late payments occurred LESS THAN than two years ago. Lenders want a clean recent payment history. Check HERE for some general criteria used within the lending industry when you have late payments.

Collections, Judgements, and Tax Liens

If your credit history indicates unpaid collection accounts, most "A" grade loan lenders will require these amounts to be paid off before the loan is funded. FHA typically will ignore them if they are under $2000, and more than 2 years old. Medical collection "usually" are ignored. Judgments' (you got taken to court & lost), are always REQUIRED to be paid off before you can get a mortgage loan.

Bankruptcy

- If your bankruptcy is more than 2-year old, you can usually be approved for an FHA loan with as little as 3.5% down.

- If your chapter 7 bankruptcy is older that 4-years, and you have good re-established credit, you may now qualify for an standard conforming loan.

- If your chapter 13 bankruptcy is 2-years after discharge date and you have good re-established credit, you may now qualify for an standard conforming loan.

- If your chapter 7 bankruptcy is 2-years after discharge date and you have good re-established credit, you may now qualify for a VA loan.

- If your chapter 13 bankruptcy has at least 1-year of on time payments, you may now qualify for a VA loan.

- If your chapter 7 bankruptcy is 3-years after discharge date and you have good re-established credit, you may now qualify for a USDA Rural Development Loan.

- If your chapter 13 bankruptcy has at least 1-year of on time payments, you may now qualify for a USDA Rural Development Loan.

Foreclosure

- If your foreclosure Sheriff Sale Date is OVER 7-years old, you may qualify for a standard conventional loan.

- If your foreclosure Sheriff Sale Date is OVER 3-years old, you may qualify for an FHA loan with as little as 3.5% down payment.

- If your foreclosure Sheriff Sale Date is OVER 2-years old, you may qualify for a VA Loan with Zero Down Payment.

- If your foreclosure Sheriff Sale Date is OVER 3-years old, you may qualify for a USDA Rural Development loan with Zero Down Payment.

Short-Sale or Deed in Lieu

- If your short-sale date is more than 4-years old, you may qualify for a conventional loan

- NO waiting period after a foreclosure for an FHA Loan if you had NO late payments on ANY mortgage or consumer debt in the 12-months proceeding the short-sale AND it was NOT a strategic short sale.

- If your short-sale date is more than 3-years old, you may qualify for an FHA Loan loan

- If your short-sale date is more than 2-years old, you may qualify for a VA Loan with zero down payment

- If your short-sale date is more than 3-years old, you may qualify for a USDA Rural Development loan with zero down payment

Extenuating Circumstances

The granting of shorter waiting periods to get a mortgage loan is available for many of these loans for extreme extenuating circumstances - BUT it is VERY RARE.

- Non-recurring events way beyond the persons control that result in sudden, significant, and a prolonged reduction in income, or catastrophic increase in financial obligation, like serious illness or death of a wage earner are generally acceptable.

- Unemployment, loss of job, prolonged strikes, medical bills not covered by insurance, divorce, and the inability to sell a property due to job transfer DO NOT qualify as an extenuating circumstance

About the ONLY qualifying extenuating circumstance is DEATH of the primary wage earner, or well documented extended and serious illness of the primary wage earner.

High Debt Ratios

If your income-to-debt ratios are too high, you can either reduce your personal debt (i.e., pay down your debt), obtain a debt consolidation loan, pay down your debt with funds from the sale of personal assets (boat, camper, etc.), select a lower interest rate ARM loan, or add a co-mortgagor. If your debt-to-income ratio is over 45%, your odd's of getting approved are very slim.

We lend in MN CO FL IA ND SD WI

Not sure if you might qualify? It never hurts to apply and see? APPLY

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.