-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Smart people know to shop a couple of different Mortgage Companies for the best interest rate and closing cost combination.

The first step to understand if you've done a home loan in the past, that the old document, commonly referred to as a Good Faith Estimate (GFE) no longer exists as of Oct 3, 2013. It has been replaced with a document known as a Loan Estimate (LE) Learn more

Shopping Mortgage Estimates:

The most common way people shop for a mortgage loan is:

-

Contact a couple of mortgage lenders and brokers

-

Inquire about interest rates and programs. Ask the question "What is your interest rate for a 30-yr fixed?"

-

Get a quote. Have it E-Mailed to you

-

Go with the perceived best deal.

Comparing the results:

You are refinancing a $200,000 30-yr fixed mortgage. We'll assume you have good credit and qualify for the loan. You've shopped 4 lenders, and here are the results:Lender Contacted on Interest Rate Closing Costs A Monday 5.250% $6000 B Monday 4.875% $8500 C Wednesday 5.500% $3800 D Friday 5.125% $6300 Which Lender offer did you take? A, B, C, or D  You feel great... You've shopped, compared, and apparently saved a lot of money on your home mortgage. Most smart people would have picked Lender D. Who did you pick?

You feel great... You've shopped, compared, and apparently saved a lot of money on your home mortgage. Most smart people would have picked Lender D. Who did you pick?

CONGRATULATIONS - You just got screwed. You just paid more for your loan than you needed to.

How did this happen? Easy! Shopping for a mortgage is complex at best -- even for the savvy previous homeowner. Daily rate changes, time sensitive lock-in periods, points, lender's fees... plus the emotional element of probably the largest purchase any of us will ever make. Throw in to this already murky stew the ingredients of tricky rate advertising, commissions for every officer, agent and broker who 'helps' in your transaction, and the obscure differences between 'rates' and 'fees.' It's no mystery that many buyers settle for a mortgage that exceeds their monetary means out of sheer exasperation!

Analysis of the different Loan Estimates (formerly known as a Good Faith Estimate): A Contacted on Monday. The Loan Officer asked all the right question, and did a good analysis of your overall financial situation. Got accurate information, including escrow information for taxes and insurance. They offer a written satisfaction guarantee, and are a local company. At closing, your estimate matches perfectly to the final numbers. B Contacted on Monday. Internet web site. You didn't actually talk with anyone. You used their online system to generate a estimate. Their system is actually giving you a rate bought down with discount points. Do you want to pay points? Their estimate is calculating incorrect tax and insurance numbers. You like the rate, but not the costs. At closing, the numbers that can change on the new good faith estimate do, and by a lot. C Contacted on Wednesday. The company is offering a "No Cost", or "No Lender Fee" refinance. They also under estimate you tax and insurance escrows. You like the low closing costs, but don't like the higher interest rate. You are smart enough to calculate how much more you will pay in excess interest over the years, and it is a lot more than you ever saved in closing costs. At closing, the numbers that can change on the new good faith estimate do, and by a lot. D Contacted on Friday. The Loan Officer asked all the right question, and did a good analysis of your overall financial situation. Got accurate information, including escrow information for taxes and insurance. They offer a written satisfaction guarantee, and are a local company. At closing, your estimate matches perfectly to the final numbers.  I'm Confused. How did I get screwed?

I'm Confused. How did I get screwed?

In this example, clearly Lender A and Lender D are the good mortgage company choice. Lender D has a better interest rate, and his costs are only slightly higher, so you choose Lender D.Why is this still the wrong choice? Because you compared estimates from different days. Interest rates can change daily, sometimes hourly. While Lender D looked good, you contacted him on Friday, and maybe rates dropped all week long. If you had contacted Lender A again on Friday, his rate would now have been 5.00%.

Wow, this is more complicated that I thought?

Yes it is. That is why we suggest you stop shopping mortgage lenders solely by comparing Loan Estimates, and start shopping for a good mortgage lender. If you are working with a highly trained, dedicated Loan Officer who works at a great mortgage company, you don't have to worry about their estimate. Get more information on how to shop mortgage companies.

History of The Good Faith Estimate - Loan Estimate

The Good Faith Estimate (GFE)

In 1974, RESPA, the Real Estate Settlement and Procedures Act swept into law, prohibiting many negative lending practices, and putting into place rules and regulation designed to assist consumers. One of these items was the creation of the "Good Faith Estimate". Since 1974, little has changed about the form, or the process Americans endure when they buy and refinance their homes until January of 2010, when HUD changed the mandated disclosure form of the key loan terms and closing costs consumers pay when they buy or refinance their home (the Good Faith Estimate).The 1974 to 2010 Good Faith Estimate was a one page document, that was supposed to accurately show all the fees and costs to buy or refinance a home. Home owners though the document had to be accurate, but unfortunately, bad lenders used non-standard forms, and would many times be miles off between the original estimate, and what a homeowner saw at the closing take. There were no real consequences for lenders not being accurate on their disclosures.

The "new" 2010 Good Faith Estimate disclosure

After the real estate collapse of 2008, many changes came into the mortgage industry to better assist consumers in their lender choice. Paramount was a new standardized Good Faith Estimate form that REQUIRED lenders to be accurate. HUD requires all lenders use the new standardized format for Good Faith Estimates effective January 1 2010.

The new estimate form was dramatically different from the old form. This caused plenty of confusion and trouble with consumers used to reading the old Good Faith Estimate form. For example, the new form didn't even give the consumer a full payment, and while it shows closing costs, it didn't factor in items like lender credits, seller paid closing costs, or any credits for earnest money. There was so much trouble with the "new" Good Faith Estimate, that the CFPB (Consumer Financial Protection Bureau) almost immediately worked on scrapping the "new" Good Faith Estimate once this new consumer protection bureau came into existence with the advent of the Frank / Dodd Financial reform laws.

New Mortgage Loan Estimate disclosure (LE) - 2015

To bring clarity, the CFPB released and required all mortgage lenders to use the new Loan Estimate (LE) form, and retired the name Good faith Estimate on Oct 3, 2015. Once again, a completely redesigned document. At first glance, the new standardized format of the Loan Estimate would appear much easier to read, understand and digest by the average borrower. Only time will tell how consumers react to the form, but as a Loan Officer, I like it.

In conjunction with the new Loan Estimate, a new final settlement document was created, called the Closing Disclosure (CD). This replaces the former closing document called the HUD1 Settlement form.

WHY LENDERS MAY NOT GIVE YOU AN OFFICIAL LOAN ESTIMATE INITIALLY

Current mortgage rules require the Loan Estimate be accurate and binding. Until the lenders knows all your details (including name, social security number, estimated property value, and property address), you are likely to end up getting some other document to give you initial basic numbers for interest rate and closing cost numbers. Once all these items are know, the lender is required to give you a Loan Estimate. Any time the numbers change (you increase or decrease the loan amount, you lock the interest rate, etc), the lender is required to give you a new Loan Estimate.

On the positive side, the new LE now shows items which CAN NOT CHANGE after getting the estimate. This will ELIMINATE the low ball quotes many mortgage brokers used to fool customers. It shows the items that are allowed to change just a little, and the items which can change a lot (escrows).

Understanding The New LOAN ESTIMATE (LE), which replaced the Good Faith Estimate (GFE)

The 2015 Loan Estimate is designed to combine the old Good Faith Estimate disclosure with elements of the old Truth-in-Housing disclosure. These old documents consisted of 5 pages, while the new Loan Estimate is only 3 pages.

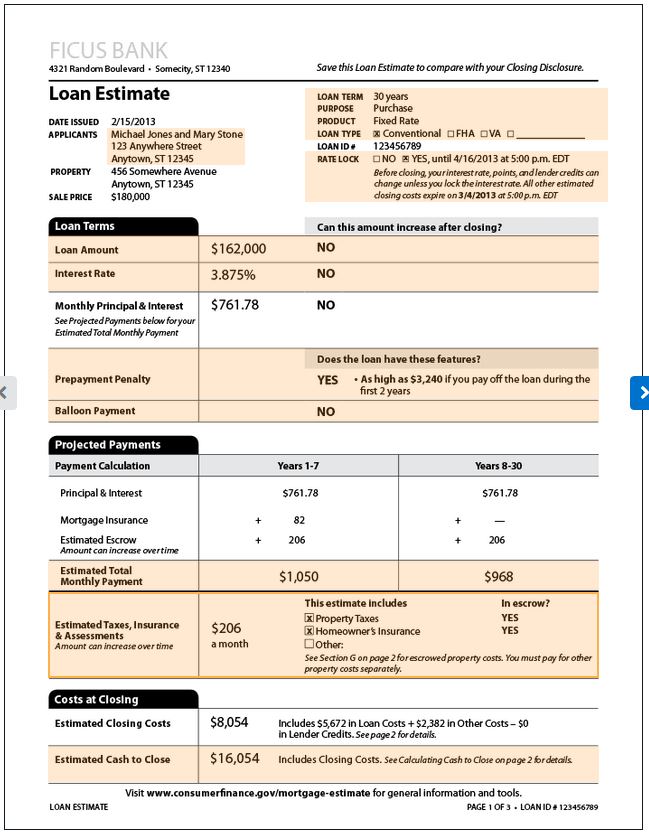

Let's explain the top half of Page 1 of the new Loan Estimate (LE) form.

Name, address, etc of both the lender and the customer. It also asks for a Property Address. The property address is important. There are different requirements if a lender does not have an actual property address. Obviously refinance transaction will have an address right away. If you are buying a home, you may or may not have an actual property address at the time the estimate is provided.Date issued, your name, address, etc. Followed by the property address, and sales price if a purchase.

The right hand side shows important basic loan information, like term, product type like fixed, or FHA, and then if the loan interest rate is locked or floating (not locked).

Loan Term Section

Loan amount, interest rate, and projected principal and interest payments are listed here. This is the loan only. Full payment with taxes and insurance are in the next section

Projected Payments Section

This section now tells you your full payment, inclusing any mortgage insurance, property taxes, and homeowners insurance. It also tell you if your payment will change, for example if mortgage insurance falls off.

Costs At Closing Section

This area gives you the loans estimated closing costs only. This includes all fees and costs from all parties, and will include any lender credits for interest rate selected, or discount points to lower your rate (if applicable).

The last line on the page tells you the estimated amount you will still need to have at closing, which would include your down payment.

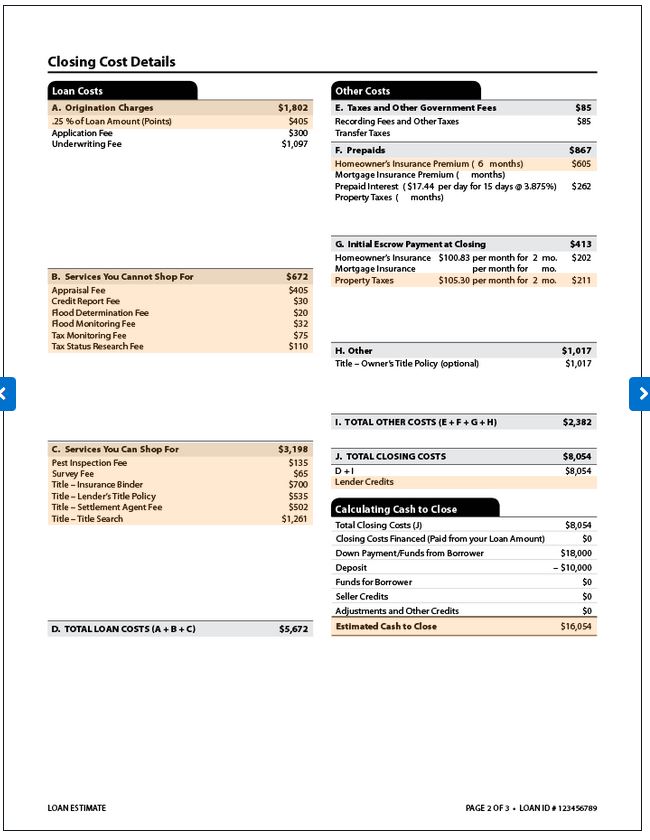

Moving on to the new Loan Estimate page 2.

This page essentially now details and breaks down all the loans closing costs. Total for each section is at the top, then the individual bread down. I personally think this is backwards, as it should give each breakdown, then a total, which is how most people think. I've already had a few confused clients over this.

Services you can and can not shop for Section

Some items in the loan process you can pick on your own provided. This included primarily the closing agent (title company or closing attorney). Some items you can not pick, like the appraiser or credit bureau.

Other Costs Sections

This area primarily breaks down county recording fees, and pre-paid items due at closing, like your first years homeowners insurance, and days of interest due from the date of closing until the end of the month you close in. If you are escrowing for taxes and insurance, and most people do, this next area gives you a break down of what the lender will need to collect at closing to set-up and start your escrow account.

Calculating Cash to Close Section.

Finally, everything is added up, and any credits given to get your total. This includes all fees from everyone involved, and items like seller paid closing cost credits, and lender credits for the interest rate selected.

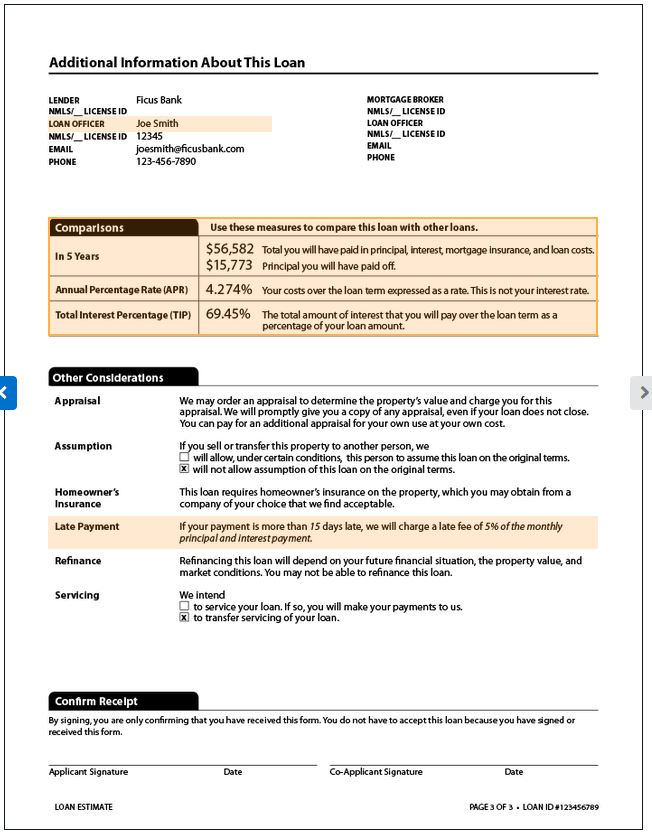

Mortgage Loan Estimate - Page 3

The top of page 3 gives you all the lender contact information.

Comparisons Section

This area gives you the cost of the loan over the first 5-years, and tells you how much you will have paid down over the first 5-years.

APR

APR has always been confusing. It is not your interest rate, but is the cost of the loan expressed as a rate. The best example I can give is taking a loan with mortgage insurance. Your APR will be a lot higher because it is taking the base rate plus adding the cost of the mortgage insurance. Read my article on Beware of Shopping by APR for a more detailed explanation.

TIP (Total Interest Paid)

This is a new item, not seen on the previous Good Faith Estimates or Truth-in-Housing documents. On the old Truth-in-Housing disclosure, it listed a number of what you would pay for the loan in total if you kept the loan to term, never sold, never refinanced, and never made any extra payments.

TIP tries to do something similar, by showing you how much of the total in payments would be interest if you kept the loan to term, never sold, never refinanced, and never made any extra payments.

The final section gives you some information about if the loan is assumable, homeowners insurance, the appraisal, who will service your loan (who you will make payments to), and late payment fees.

Be sure to read our section of shopping Loan Estimates (formerly called a Good Faith Estimate).

#1 MOST IMPORTANT ITEM TO REMEMBER:

All lenders have about the exact same costs for doing your loan - NO ONE can do your loan significantly cheaper than anyone else can. Anyone more than just a couple of hundred dollars cheaper than everyone else, or with a rate more than just a 1/4% lower on an estimate is something you should investigate further.TThe Loan Estimate is only one part of your shopping equation. Picking the lender solely by the lowest rate or closing cost on your estimate can be a very costly mistake! A great rate on the wrong product is never a great deal.

Learn about our /font> Lowest Rate, Lowest Cost COMBINATION Guarantee!

The use of this new estimate form is MANDATORY and must be provided to customers:

-

Within 3 days of a full loan application.

A loan application is deemed taken by a lender with the borrowers' names, social security numbers, incomes, estimate purchase value, loan amount, other information deemed necessary by lender and property address. This form must only be utilized if there is a specific property address.

While home buyers have used the GFE to shop for lenders, they really can no longer do that. Without a property address, the lenders will come up with "preliminary" estimate forms, and only issue real Good Faith Estimates when compliance requires. -

Good for 10 days of issuance.

The Loan Estimate will be good for 10 days after the borrower receives it. The borrower MUST express an intent to proceed with the terms and conditions of the loan based on the LE provided within 10 days business. After 10 business days, the lender is no longer bound by the issued estimate.

This is HUD's effort in facilitating consumer comparison shopping of Lenders. It is not the most perfect version out there, but it is a much simpler method for an average consumer to understand.

By following these rules, you should always be able to make the correct apples-to-apples comparison:

-

Always use a local non-bank lender. Make sure you are dealing with a local rules. Internet Mortgage Companies are notorious for screwing up loans, under-estimating Loan Estimates, and giving misleading interest rate quotes. Although you may have found us on the Internet - We are NOT an Internet Mortgage Company! We are a Minnesota Based Direct Mortgage lender doing loans primarily in Minneapolis and St Paul Metro area with a web site. We lend in MN, WI, and SD.

-

A couple hundred dollar difference in bottom line fees on an estimate is meaningless because of the variations in how lenders calculate costs. All estimates within a couple hundred dollars either way should be considered equal.

-

Don't fall for "we don't charge for" statements. Nothing is free, and YOU always pay.. If a standard fee is missing, it is always being paid for with a higher interest rate.

-

Closing Costs / Lender Fee's. - Don't be fooled. DON'T call and ask "what is your interest rate?" Instead, TELL all the lenders you are shopping with what rate YOU want, then ask for a quote based on that rate. By asking in this manner, you eliminate 90% of the misleading games some lenders play in attempting to make their offer sound than everyone else.

-

NEVER pay applications fees. You may be asked to pay a credit report fee up-front. This is OK. You will be asked to pay the appraisal fee once you agree to officially move forward with the loan. NEVER pay non-refundable applications fees regardless of what the lender promises.

-

COMPLETELY IGNORE any interest rate or closing cost estimate you see online. They are never accurate. You must speak to someone!

-

NEVER use an unknown lender who solicited you through the mail, or called you on the phone. These are by far the worst rip off, misleading, overcharging, predatory lenders that exist!

-

Call or fax us with the other company's estimate. I will be happy to help you review them (MN, WI, and SD homes only please).

-

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.