-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Interest Rates Locks and How They Work

When initially getting a mortgage loan, you have an important decision to make about interest rates.You need to decide if you want to either float or lock your interest rate. Float means your rate is NOT guaranteed, and subject to change. Basically you are playing the market, and hoping interest rates get better. Locking your interest rate means you like what you are being quoted, and that you choose to LOCK that rate. After locking your interest rate - you are done. It is chiseled in stone. If interest rates move between locking the interest rate and your loan closing, you DO NOT get a lower rate if rates move down. It also means you WILL NOT be charged a higher rate if interest rates go up.That's all well and good for people refinancing their existing loan, and home buyers who have already signed a purchase agreement on a typical home purchase. But customers who are building new construction, and need a new construction loan, usually can't close in that relatively short time frame and therefore have a much harder float or lock decision.Mortgage Rate Lock or Float?

Borrowers who are shopping for new homes or planning on building one themselves should keep these interest rate options in mind. But buying long-term rate locks is a little like buying insurance: You don't want to buy too much protection because that gets too costly and you don't want to buy too little coverage, either, because doing so can leave you exposed if calamity strikes. View our Mortgage Rate Lock Advisory page to help you decide if you should lock or float your interest rate.

Mortgage Rate Lock Period

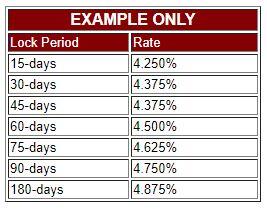

Mortgage interest rates vary based on lock period. The longer the lock period required, the higher the interest rate. For example, you might see something like this when being quoted interest rates. See the example graphic for an idea of how this works.

The longer out before your closing, the longer rate lock period you will need. See the example graphic on how this may look, and remember, this is just an example, not an actual rate.

Almost all interest rates you see online, and most mortgage lenders quote mortgage rates based on the assumption their borrowers will close in less than 30-days, as that 'shows" the lowest interest rate, but isn't realistic for most new construction loans.

Consumers can usually lock their interest rates free, or with no additional up-front costs for up to 75-days. Anything longer, usually requires up-front lock fees that are usually non-refundable.

Many mortgage companies can offer interest rate locks well over the most common 60-day rate lock, including rates locks of up to 1-year out.Example Rate vs Lock Period

Remember, Interest Rates Change

Many people quickly think that it may be smart to just wait a few days to lock on a shorter lock period to get a lower interest rate. This would be great, if interest rates never changed. But change they do - sometimes multiple times during the day. Holding out for a rate 1/8th lower initially sounds great - but what will the actual interest rates be a week from now, two weeks from now, or a month from now?Long Term Mortgage Rate Locks

Long-term rate locks help minimize the worst-case scenario for the home buyer. If interest rates improve or stay unchanged relative towhere rates are today, or if the market gets worse, you always know what your rate will be, without further worry. But, reviewing the sample chart - this comes at a cost.With most MN, WI, IA, ND, SD, CO, FL mortgage lenders, for instance, someone waiting for a builder to finish a home can apply for a mortgage now and purchase 120 days of interest rate protection. The customer typically would have had to pay one point, or one percent of the loan amount, up-front, at the time of locking, for the protection. That would lock in the mortgage loan at a rate slightly above the standard 60-day rate. By collecting the point up-front and possibly paying it back only if the borrower closes, the lender protects itself against the possibility the customer will defect to another lender during the time before closing.Those up-front fees come in two flavors; Creditable and Non-Creditable. Make sure you know which one your lender is offering.- "Creditable" means the customer would have the up-front fee credited toward the loan's closing costs at closing time.

- "Non-Creditable" means the fee is paid to secure the rate only. It is NOT applied toward future costs, or credited at closing in any manner whatsoever.

Referencing our sample rate chart again, the further you go out on the spectrum (of lock days needed), the higher the rate becomes. You've got to be reasonable in terms of what you think the expectations for closing are going to be and pick the lock period that gets you through that key date. The biggest risk we see is people pick too short a lock period. If they get a 120-day lock, and if that house isn't ready to close, they end up needing to go through another 30 to 60 days to close the deal and they've basically exposed themselves to market risk.Mortgage Rate Lock Float Down Rules and Options

Interest rate float down options are usually available, and come in many different flavors. Be sure you completely understand the rules of your lender's float down option BEFORE locking the loan.Typically, you will get one chance to switch to a better interest rate if the interest rates improve. Some programs allow you to switch at anytime prior to closing, while some allow for you to switch only within the last 30 days before closing.Most interest rate float down options typically REQUIRE you TELL THEN LENDER you wish to have this option BEFORE LOCKING. You can NOT just ask for a float down later on if rates go lower.

Today's Mortgage Rates in MN, WI, IA, ND, SD, CO, FL

You can view current MN, WI, IA, ND, or SD interest rate averages right online. No SSN# needed.If you need a long term interest rate lock, call our mortgage experts at (651) 552-3681, or fill out our no obligation interest rate quote form. A Loan Officer will review it, then contact you back to discuss your options.

You can view current MN, WI, IA, ND, or SD interest rate averages right online. No SSN# needed.If you need a long term interest rate lock, call our mortgage experts at (651) 552-3681, or fill out our no obligation interest rate quote form. A Loan Officer will review it, then contact you back to discuss your options.

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.