-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

The Real Truth About Advertised Mortgage Interest Rates:

Understanding how mortgage interest rates work, and why you probably won't get the interest rate you see online or elsewhere is probably one of the most confusing aspects of any mortgage loan.

While you see interest rates online, or in printed material such as newspapers, you must understand all lenders have the same basic interest rates and hard costs. No one lender is able to be significantly better than anyone else.

It is all about the advertising, and the rate and costs combinations. It is our belief that posting rates is basically unfair to most consumers. We list national mortgage rates averages on this website to give you a basic indication of where the market is at, as opposed to what YOU may actually receive, because:

- Quoting rates without understanding the customers exact situation, or having a full application CAN BE VERY misleading. Many things effect your actual rate. Loan-to-value, credit scores, state the property is in, closing costs options YOU choose, and much more. Only a professional analysis from a licensed Loan Officer who has reviewed a full application and credit report will generate an accurate quote.

- We are in a world economy. Interest rates fluctuations can and do occur around the clock. Interest rates are changing ever second of the day and unless you communicate with a Loan Officer and get information at that moment in time, you could be making a poor decision. Most lenders, as well as us, change their pricing throughout the day. It is nearly impossible to always keep a web site 100% current.

- Quoting interest rates when you can’t lock (after hours), or when you a mortgage lenders hasn't reviewed a full application, therefore not being in an actual position to lock, is not in your best interest.

- If you are buying a home, and do not have a signed purchase agreement yet, many lenders knowing quote a fake lower to get you to think they are great, and stop shopping. They don't have to honor what they quote today, and when you are ready to lock a rate, they just give you the real rate of the day.

- Most automated online rates quote systems only calculate a "best case" situation, and nothing is guaranteed until the lender has taken a full mortgage application, reviewed all documents v ital to your transaction, including W2's, pay stubs, banks statements, a credit report, and appraisal.

Rates Change

Due to the ever-changing nature of mortgage interest rates, it is almost impossible to keep a web site current. For example, a client may visit the site at 12:00 PM only to call at 2:00 PM and find that the rates have changed.

Therefore, we prefer you contact us, or complete our ONLINE QUOTE FORM for a more accurate and expedient method in relaying current interest rates to our prospective clients.

Understanding Rate and Cost Combinations

While rate is important, you have to look at the overall cost of your loan. (Click HERE for REAL closing cost information) This includes looking at the APR, the loan fees, as well as the discount points and origination fees.

Most lenders include standard 1% loan origination costs in their quotes, some show lower closing costs by having no loan origination costs. Sounds great, but do you realize they just increase the interest rate so you pay the costs over time versus up-front today?

Other lenders are including discount points to offer their great rate, while doing everything they can to avoid you finding that out until much later in the process because most people don't want to pay discount points.

So when one lenders says 2 points they mean 2 points, whereas another lender means 2 points plus 1% origination. Some lenders quote "lender fees plus prepaids" when you ask about closing costs, where other lenders quote every penny required to complete the transaction. The quoted difference can APPEAR to be thousands of dollars, when in reality, it is not.

I usually explain three interest rate and closing cost options to each client, so they can pick what is best for them:

- Normal: You pay all the normal closing costs, including loan origination. Generally best for most people.

- Lower Costs: Your interest rate is higher, but your closing costs are less. For example, a 'no origination' fee loan is generally 0.25% higher interest rate on a 30-yr fixed loan. Generally best if you are tight on down payment money and cash to close. Also OK if you are going to be in the home only a few years.

- Lower Rate: You pay all your normal and regular closing costs, PLUS you are paying additional discount points to lower the interest rate. Works best for those who know they are going to be in the home 10-years or longer, AND have the additional money to buy the rate down today

None of these options are automatically good or bad. They are just options.

The cost/rate of the mortgage, however, cannot be your only criteria. There is no substitute for asking family and friends for referrals and for interviewing prospective mortgage companies. You must also feel comfortable that the Loan Officer you are dealing with is committed to your best interests and will deliver what he/she promises! [Read about Joe Metzler]

That the company knows how to do Wisconsin, Minnesota, and South Dakota mortgage loans, and that the loan will actually close on time as promised.

Communication with your loan officer is too important to let a "lowest rate" quote from some hack shop on the Internet make your lender decision.

More About Mortgage Interest Rates:

The Law REQUIRES ALL LENDERS TO QUOTE "APR", not interest rate.

APR is probably the most confusing item in a mortgage loan. The basic idea is it takes your loans real interest rate, then factors in closing costs to get you the APR (annual percentage rate). I have a whole different article on how choosing your mortgage loan by APR can cost you money.

- It is almost impossible to quote APR (annual percentage rate) without discussing the exact details of your specific transaction with you. If you have less than 20% down or equity, make sure they include PMI in the APR (as required by law).

- Interest rate may vary depending upon your unique credit history and the transaction, plus you may not qualify for the desired rate or program.

- Most online rate quotes "assume" a 20% down payment, and a 30-day lock. This may not fit your needs, and could easily distort your rate shopping.

- Most online rate quotes are for loan amounts about $200,000

Be sure to read "Beware of the BAD Good Faith Estimate" so you don't get taken by misleading information.

PRO TIPS: Avoid Internet Lenders and Stick with a Local Company! There is nothing from some out-state internet boiler room operation that you can't get from the lender down the street.

For refinances, almost without fail, whoever has your loan now is never the best deal.

Searching Interest Rates?

Searching rates on home loans, or rates for refinancing your mortgage in MN, WI, IA, ND, or SD? We have some of the best rates on home loans!

Remember, no lender is able to quote 100% accurate rates until they have a full application, have reviewed credit, etc. Rates posted here are an indication of where the market is generally at, as opposed to what you may actually receive.Although you may see Interest Rates published on the Internet and in the Minneapolis paper, or your local newspaper, many times these are primarily "teaser" rates. Be careful of focusing too much on a published Interest Rate from sources such as the newspaper, or on the Internet, that appear to be objective, but are really items they push for their paid advertisers. They appear competitive, but may really be a representation of a product that does not relate to your situation, or more often, comes loaded with points or costs you do not want to pay. Your final interest rate will be determined by several factors, including credit, loan amount, loan-to-value ratio, and debt ratio.

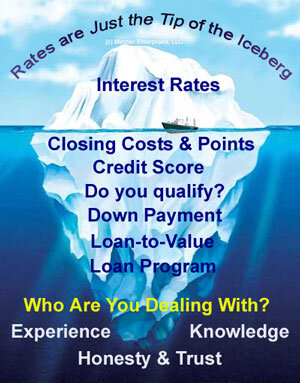

We maintain the lowest TRUE closing costs in the industry, and the Minneapolis, St Paul Minnesota area. Even for first time home buyers! When comparing rates in Minnesota, Wisconsin, and South Dakota, be sure to compare closing costs too. An Interest Rate quote is just the tip of the iceberg, and basically meaningless unless you know who your dealing with, and fully understand the associated costs! There is so much more to your loan than looking at some low teaser rates through some automated web site quoting system! That is why you won't find rates here. We believe in accurate quoting based on your exact situation.

Our lender closing costs and Third Party Fees are extremely low, as we DO NOT add any junk fees to your closing costs. Don't sacrifice service, your time, and your credit scores shopping when we offer a Satisfaction Guaranteed Rate

We remain as one of the most popular mortgage sites on the Internet for Minnesota, Wisconsin, Iowa, North Dakota, and South Dakota homeowners, and it's not just because of our LOW rates. Its because we offer the whole package!

We are a Minnesota based direct lender and mortgage broker, giving you the best of both worlds. We offer great rates, qualified Loan Officers, and a wide range of products. We keep it simple! Slick advertising is not our game. We think MATH and so should you! Before choosing any lender, read "Rate Shopping" and learn how to cut through the advertising BS!

TOP REASONS YOU SHOULD HAVE US HELP YOU:

- Extremely low competitive interest rates

- Low 'real' closing costs

- Mortgage Lender and Mortgage Broker - The best of both worlds!

- Professional highly trained experts to help you select the right mortgage program. Not just application takers.

- Honesty, Integrity, Experience.

- We make the process easy, convenient, and painless

- 5 Star Satisfaction promise

We provides fully automated processing, with all of the latest approval systems, and give you instant Email notification of each step of your loan! As both mortgage bankers and mortgage brokers, our clients receive double benefits with one loan application.

- Knowledgeable experience mortgage consultants

- Accurate, Loan Estimates (formerly called a Good Faith Estimates - no obligations)

- A quick review of the mortgage process (so there are no lost opportunities or misunderstandings)

- Creative ways to save you money! (you may not think of everything, but we do!

Best Rate or Lowest Cost? Don't be fooled by one or the other.Read these articles for more eye opening information.

- Beware of the BAD Good Faith Estimate to Avoid the pitfalls of misleading estimates.

- Using APR to select your loan CAN COST YOU MONEY! The lowest APR does not automatically mean the best deal.

- Long Term Locks - Not closing for awhile? Click here for long-term lock information.

- Thinking of breaking a rate lock? It may not be worth it!

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.