-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

So you need a mortgage loan. Who do you use, a bank, a broker, or a direct mortgage lender? All will get you a loan, and all have 'Loan Officers'.

Let's explore the differences:

When you're looking to get a mortgage loan, you will of course deal with a Loan officer, but where they work, and their background can make a huge difference. People often confuse the different lender types, because they will all glean the same results: a new home, or a lower rate on your refinance. However, it is important to understand the difference between the three types of lenders so you know what to expect from them during the mortgage application process.

Lender Differences

[OK]: A Bank loan officer is a representative of one lending institution, the bank, who works to sell and process mortgages and other loans originated by their employer. They usually are limited in what they can offer to only their own products, severely limiting your loan rate, cost, and product options. These loan officers represent the borrower to just their lending institution and may guide him or her through the selection, processing and closing of mortgage loan. Most bank Loan Officers tend to be more of just an application clerk, versus a professional Loan officers. They can be paid a commission, salary, or both for their services. There are no deals at banks... ever. Sometimes, because of disclosure laws, it may appear that way. You see, non-bank lenders and brokers are held to a significantly higher standard than the banks by both Federal and State laws.

[Better]: A Mortgage Broker is an individual or firm that is the middle man between you and the actual lending institution, which can be a bank, trust company, credit union, mortgage corporation, or finance company. They will originate your loan; collect your information, then submit your application to one or more lenders, and work with the chosen lender until the loan closes. Brokers have no money of their own, do not make loan decisions, and have no underwriters. Mortgage brokers CAN NOT issue loan commitment letters (only the actual lender can - although most brokers do anyway). Brokers can receive their fee from the borrower, be paid from the real lender if the loan closes, or both. Loan officers at brokerages are required to be licensed.

[Best]: A Direct Lender / Mortgage Company or Correspondent Lender is an individual or firm that originates, processes, underwrites, issues loan commitments, closes, and funds their own loans with their own money. Most have in-house underwriters, and have direct access to loan products from all the big national players. If a mortgage loan programs exists, they can usually offer it. Direct Lenders typically bundle and sell your loan after closing to giant Fannie Mae or Freddie Mac servicing companies. Most correspondent lenders are also able to broker loans if needed, giving you the best of both worlds. (This is who we are)

Loan officers with a direct lender will analyze your financial situation to determine which loan is the best fit for your financing needs. Direct lenders can be paid a fee for their services from the borrower, the lender whom they sell your loan, or both. Loan Officers at these type of companies are required to be licensed, and are typically the best and the brightest Loan Officers in the mortgage lending field.

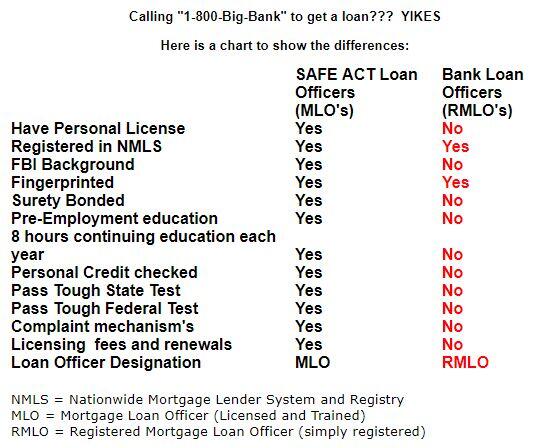

BIG Bank Loan Officers versus SAFE ACT Licensed Loan Officers? You Make the Choice!

Washington has been busy protecting consumers from bad lenders right? Well, not really. While they have done a few things right, they have also done a lot wrong. One of the biggest mistakes has come in Loan Officer licensing requirements. Sadly, the general perception by the public as to who is the better lender choice is completely wrong. Most people feel the brokers and the non-bank mortgage lenders have created all the problems. This is mostly because of what the politicians and their big banker friends like to say, not something based on actual facts.

Consider the fact that Fannie Mae, Freddie Mac, and banks make the rules, and the banks review, underwrite, and fund the loans for brokers. So who is fooling who? Fat cat banking industry lobbyist are spending your tax dollar with their bail-out money to portrays themselves as innocent victims, and have done a wonderful job getting that incorrect message sent to Washington.

Effective January 1, 2011 all Mortgage Bankers and Mortgage Brokers across the county were required to meet new strict standard, and to be licensed according to the S.A.F.E. Act., that is UNLESS they work at one of the big banks!

An exemption in the consumer protection laws allows Loan Officers at the big Interstate Chartered Banks to NOT have to follow the same rules! Who are these banks? All the big names (Wells Fargo, US Bank, Chase, Bank of America, etc.), plus plenty of smaller ones.

An exemption in the consumer protection laws allows Loan Officers at the big Interstate Chartered Banks to NOT have to follow the same rules! Who are these banks? All the big names (Wells Fargo, US Bank, Chase, Bank of America, etc.), plus plenty of smaller ones.

Now I am not trying to make this into a David versus Goliath story, but I am trying to emphasize the huge differences and implications this change will have on the consumer. As the new requirements have been rolling out across the country, many of the current Loan Officers who have been unable to meet the new requirements, and especially those who have failed the new tests, have simply gone to the large banks to work.

Call us now to find out the advantage correspondent DIRECT lending can mean for you on your home loan for properties in Minneapolis, St Paul, Duluth, Rochester, Madison, Milwaukee, all of Minnesota, Wisconsin, and South Dakota!

What is Correspondent DIRECT Lending? We are a direct lender! We fund our own loans!

It is much easier to become a mortgage broker, while it is much harder to be a actual lender. There are two primary criteria few brokers can meet. The first is a seven-figure plus net worth requirement. The second is an initial audit process that scrutinizes past transactions. You're ineligible if predatory lending practices are found, or questionable transactions are uncovered.

Our correspondent direct lender status is hard earned and we believe it affords our loyal following of customers many benefits.

Question:

What is a correspondent direct lender, and why is it so important to us?

Answer:

Simply put, you want only the cream of the crop, no matter what you are doing. A correspondent direct lender is just that. The term says their mortgage company originates, processes, underwrites, issues loan commitments, closes, and funds their own loansQuestion:

What is the difference from a plain mortgage broker?

Answer:

Mortgage brokers can NOT issue a loan commitment, or a real Pre-Approval letter. If you are working with a broker, and they have given you a pre-approval letter, it is a worthless piece of paper, and in violation of law unless a real lender they submitted your loan to has actually approved you.

They originate, and process your loan (help you get the paperwork together and verifies the information for the real lender), but they do not underwrite, close, or use their own money. The borrower often doesn't deal with the real lender, or even know who the real lender is until closing. The process works, with one exception - you may not get the best deal. The higher rate you pay, the more the broker earns. You might also be very surprised to find out that many so called "top lenders" are really just small brokers with 10 employees or less! Is this who you want to deal with?Question:

Why are there so few correspondent direct lenders?

Answer:

Mainly because it is easy to become a mortgage broker, while it is hard to be a direct lender. There are two primary criteria few brokers can meet. The first is a seven-figure net worth requirement. The second is an initial audit process that scrutinizes past transactions. You're ineligible if predatory lending practices are found, or questionable transactions are uncovered. Our correspondent direct lender status is hard earned and we believe it affords our loyal following of customers many benefits. Unfortunately, it is extremely easy to become a simple mortgage broker.Question:

What are some of the other benefits?

Answer:

First, our clients prefer the process to be completely self contained, providing them with superior privacy, security, and pricing.-

Correspondents typically get better pricing from funding sources, with fewer loan program restrictions.

-

Many of the highest producing real estate agents refer their clients to correspondent lenders only. It makes their buyer's offers more credible to sellers, and provides all parties involved in the transaction more confidence that those lenders will get the loans closed on time, every time, or they wouldn't have been approved as correspondents in the first place.

-

The vast majority of conforming fixed mortgages are sold by correspondent lenders to large servicers. Because of the high credit quality of these entities, the original mortgage loans can be offered at lower rates.

Banking Institutions, Credit Unions, mortgage brokers, and many traditional mortgage companies are limited by the number of mortgage programs they can offer. These lenders typically represent one, or just a small handful of investors.

Correspondent direct lending allows you to find the right mortgage program for your needs from hundreds of financing options. Our expertise in understanding home-lending options ensures that the qualifying and approval process goes quickly and smoothly.

-

How to Verify a Loan Officer

All mortgage loan officers must have and display an NMLS number on web sites, business cards, advertising, etc. NMLS stands for Nationwide Mortgage Licensing System and Registry.

Many people assume this NMLS number is an actual license number, when in reality it is simply a registration tracking number. Well over 50% of mortgage loans officers are simply registered, not actually licensed.

TIP: Only work with licensed Loan officers.

To determine if your Loan Officer is simply registers or licensed requires you to visit https://www.nmlsconsumeraccess.org. Once there, you can enter the Loan Officers name or NMLS number. Once the Loan Officer is displayed, you need to go to the bottom of the page to determine if licensed or just registered.

- A fully LICENSED Loan Officer will list one or more state licenses that that person is licensed in under "State Licenses/Registrations" (for example, mine shows I am licensed in MN, WI, and SD)

- An UNLICENSED and simply registered Loan Officer will say under "Federal Registrations" something like "Federal National Mortgage Originator" - A pretty fancy title for not licensed.

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.