-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Every mortgage company lender must obtain a credit report to determine your credit worthiness. Upon reviewing your mortgage application, your credit report is pulled to help make a determination regarding your home mortgage loan approval or denial.

Mortgage companies use the standard MORTGAGE INDUSTRY scoring models. If you've gotten a copy of your credit report directly from the credit bureau's, or from some online free credit report service like Credit Karma, you are almost always viewing a CONSUMER scoring model, known as the Advantage Score.

While scoring models tend to be similar, they are not exactly the same. It is possible to get very different credit scores on the SAME DAY AT THE same time. It has NOTHING to do with the fact that someone pulled your credit, and everything to do with the different types of credit scores.

The mortgage industry pulls all three of your mortgage credit scores, then throws out the high score, throws out the low score, and bases all credit and interest rates off the middle score of the lowest applicant.

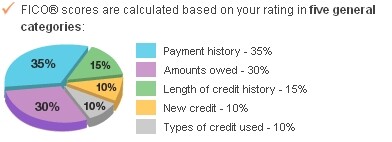

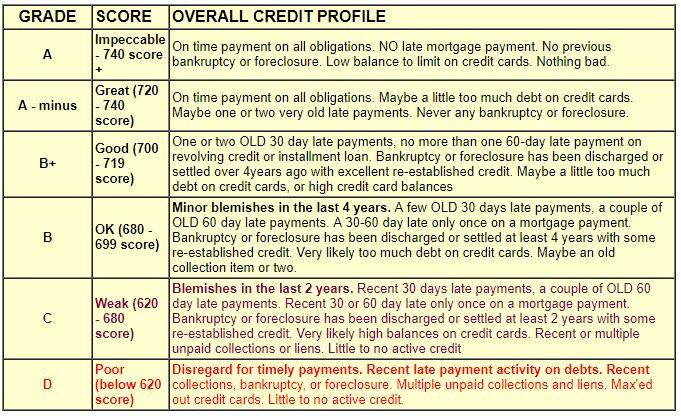

Here are some general criteria used within the lending industry to get an idea of where you sit.

Have bad credit? Read our article on BAD CREDIT Loans

WHAT'S YOUR CREDIT GRADE?

Every lender uses different guidelines to determine your credit worthiness. Upon reviewing your application and credit report, you're given a credit grade and a determination regarding your loan's approval or denial. Click HERE for some general criteria used within the mortgage industry to determine credit. Bruised Credit? Click here for more info. You might still be able to get a loan!

CREDIT SCORE GRADES, and Basic Credit Profiles

How To See Your Credit Scores

If you are not sure what your credit score is, you should officially find out. You can do that by apply for the mortgage loan. We will pull your credit, and give you a review your exact situation. Another options is to obtain your credit report free from either www.AnnualCreditReport.com (no scores), www.CreditKarma.com (score), or WalletHub.com. Many credit card or other financial services also give you a free credit score each month on your statement.

[PRO TIP]: Understand that any 'free' or credit report YOU can obtain anywhere yourself DOES NOT provide you with the same credit scoring model used by most lenders. Therefore any score you are given will likely differ from the score any actual lender provides.This includes when you buy your credit score from the actual credit bureaus. These services are useful in giving you an idea of your credit score, but don't be surprised if a lender gives you a different score.

You can get more information directly from the credit bureau's web sites.

- Experian -- https://www.experian.com

- Equifax -- https://www.equifax.com

- TransUnion -- https://www.tuc.com

Your Credit Report and FICO Credit Score

Its More Important Than You May Think.

Perhaps the most important factor in qualifying for a home loan is your credit score.

Companies such as Experian, TransUnion and Equifax routinely collect and maintain information from credit card companies, banks, department stores, etc., about your payment history, and use it to compile your credit report. In addition, they also collect information from collection agencies, county, state and federal governments, to report items such as collection accounts, judgments and bankruptcies.

The fact is today that many people have blemishes on their credit reports. Whether from divorce, being laid off, or just getting in over their heads, people can begin to re-establish their credit, and eventually qualify to buy a home. Some lending guidelines even allow you to obtain a home loan while currently in a bankruptcy and even stop a foreclosure. Just because your have a few late payments doesn't mean you can't buy a house.

Times have changed. We NO LONGER very many programs for people with bad credit. BUT, don't automatically think you can't get approved... Spend 15 minutes with a Cambria Mortgage professional to make sure. You just might be surprised at what you hear!

Inquiries on your credit report?

Thay are NOT what you think, and 99% of people 99% of the time should never worry about them,

Read our special page dealing with just inquiries on your credit report for more information.

Credit Risk Score?

Some credit grantors make hundreds even thousands of credit granting decisions every day.

To help them make those decisions faster and more objectively, they rely on a computerized process that results in a risk score (or credit score).

Your credit score is often a major factor in qualifying for credit. Lenders can obtain a computerized credit score when they pull your credit. This score is a number which represents an applicant's potential credit worthiness. Although credit scoring has existed for many years, it is gaining popularity in mortgage lending. Many loans are granted or denied on the basis of your credit risk score.

Until recently, Fair Isaac & Company, the creators of the credit scoring model refused to reveal the mysteries of what effects your score (good or bad), and how they arrived at it. Not anymore, click here for details: Credit Score Secrets Revealed. They have also recently began releasing to consumers their scores and interpretive data for a nominal fee.

Many times, information is reported incorrectly on your credit reports. A copy of your credit report can be obtained by clicking the link above. There is a dispute process that allows you to question the accuracy of items on your report, if you feel any items are improperly reported. You don't need to pay a credit repair company. One word of advice. Contact ALL THREE credit reporting agencies. Getting something corrected from one agency doesn't mean it got corrected with the other two!

Get the booklet on Understanding your FICO® score

This booklet provides a thorough description of credit scoring, including ways credit scoring can help you, the relationship between your credit report and your credit score, what a FICO® score considers, and interpreting your score.

Prevent Identify Theft: Opt-out of pre-screened offers.

Stop the flow of junk to your mailbox. The consumer credit reporting industry has provided a way to opt out and remove your name from these lists. You can contact them by phone at 1-888-567-8688 or online at https://www.optoutprescreen.com. It is quick, easy, and free - and valid for 5 years!

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.