-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

NO CLOSING COSTS LOANS: Are They A Good or Bad Idea? YOU DECIDE after reading this...

One of the most confusing areas for consumers in a mortgage loan transaction are closing costs. Here I'll explain the advantages and disadvantages of the highly advertised "no closing costs", "zero cost" or "low cost " mortgage loans.

First and foremost, there is no such thing as No Closing Costs!

Everyone knows there are closing costs associated with getting a mortgage loan; appraisal, credit reports, state taxes, county recording fees, title companies fees, lender fees, escrows, and more. Someone has to pay these closing costs and fees, and it is always YOU.

The various ways of how you can pay closing costs them is what this article tries to explain.

Homeowners need to understand that in a no lender fee or no closing cost mortgage loan, the lender simply uses "negative" points to offset your costs - also referred to as Lender Credits.

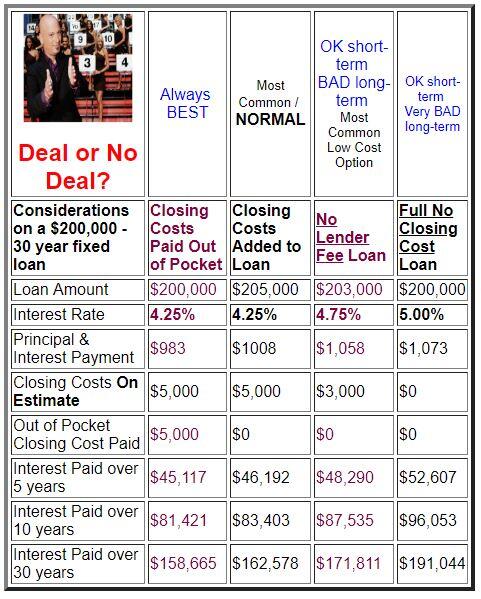

In the example below, by having the 4.75% interest rate, versus a 4.25% interest rate, you can lower or offset through a higher interest rate some of your mortgage loan closing costs. By choosing this option, it appear as if you saved thousands in closing costs. GREAT! But while lower costs always sounds good, you now have a significantly higher interest rate!

You always have closing costs. Under what cup are they hiding?

NO LOAN ORIGINATION FEE?

Many lenders claim that they don't charge the standard mortgage loan origination fee of 1%. Sounds great, but you are still paying. No lender works for free, You just pay in a different way. Under any no origination fee claim the lender is increasing the loans interest rate slightly in order to get paid over time versus getting paid up-front. This is not automatically a good or bad option, you just need to do some math to see if it makes sense. Your Cambria Mortgage Loan Officer will be happy to run both origination and no origination options for you.

OK, now what? Interest Rate versus Closing Costs

No matter what anyone says, a zero cost, no closing costs, or no lender fee loan is NOT automatically a great deal. Interest rate and closing costs go hand in hand, and YOU need to do Math.

Although it may sound so much better than paying thousands in closing costs, you have to analyze each individual loan and client situation to determine the benefits. Many lenders speak highly of the "thousands of dollars" you save with a no closing cost refinance. They never discuss the fact that you may spend significantly more in interest over the full life of the loan than you ever saved in up-front closing costs!

Pick the best closing cost option for you

In the example below, you will pay $28,466 MORE in interest over a 30-year loan by not just rolling your closing costs into the loan amount today versus a full no closing cost option. If you are going to be in the home just 5-years, you still save $6415 in interest versus a full no closing cost loan.

On the other hand, maybe you are looking to sell the home in two-years. It probably makes sense to pay a little more per month, than to add to your loan amount. Finally, maybe because of debt ratio guidelines, or where your homes appraised value came in, it may make a lot of sense to select a no closing cost loan to make the deal work.

View our live mortgage interest rate and closing cost options anytime - No Obligation, and no SSN required.

FACT: In a refinance loan, the vast majority of people roll the closing costs into the new loan amount.

A common misconception is that a zero cost, or no closing costs mortgage loan is better than adding thousands of dollars in closing costs to the new loan.

THE FACT IS PROBABLY NOT. Even if you were to only stay in the property 5 years, why have the higher payment when a few thousand dollars added to the loan principle is usually meaningless in the grand picture.

I hope this article has helped you to understand the varied measures used to determine the advantages and disadvantages of a no closing cost loans. Each borrower is different, and the evaluations must be made on a case-by-case basis. As you can see, there are many factors to consider when looking at the available options. With us as your personal Mortgage Consultants, we will be able to answer all of your questions, outline the costs and benefits, and even give you a few new ones to consider!

While everyone’s individual financial situation varies, let us show you the math so you make the correct choice.

Of course, if a no closing cost loan makes sense for your case, we will be happy to do one for you.

Get Started - It's Easy

- Apply for No Closing Cost loan

- Review with Loan Officer

- Submit Documents

- Close

- Enjoy your savings

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.