-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Minneapolis, MN: We all have credit scores, but do you know what your credit score tells creditors? It tells us your credit risk, and likelihood of the money not being paid back.

Of course a high credit score is no guarantee of being paid back, just like a bad credit low scores are not a guarantee of default, but creditors have plenty of historical data to give us an idea.

Most lending is based off what is know as 'risk based pricing', which simply means the lower your credit score, the higher risk of default, and the higher interest rate you pay for that risk.

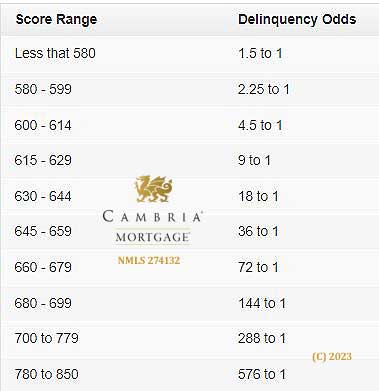

Lenders Odds For Mortgage Late Payment Risk

Press Control-D to Bookmark This Page

More Than Just A Credit Score

Other factors can come into play to help a lender mitigate risk.

Amortization period. For example, a 15-year loan is a lot less risky than a 30-year loan

Loan-to-Value (Down payment size). A smaller down payment is significantly more risky than a large down payment.

So someone with a lower score, but putting a bigger down payment selecting a 15-year loan might get a loan approval, while someone with the exact same credit score using a small down payment and a 30-year loan might get denied.

The 5 C's of Credit

The basic framework for understanding, mitigating, and measuring risk are known as the 5 C's. Here is what the 5 C's mean:

Character

What kind of person are you? Do you have a long documented credit history?

Capacity

This is about your ability to take on debt, also known as debt-to-income ratio's. Someone successfully paying rent for $2000 a month for years has documented the capacity to pay a $2000 a month mortgage payment. Someone who has lived rent free, and now suddenly has a $2000 a month house payment would suffer from 'payment shock'.

Capital

This is generally defined as overall wealth. How much money do you have saved, how much will you have after down payment. Clearly someone with plenty of money left in the bank for example has the ability to make payments for awhile if they had a job loss, whereas someone living month to month would immediately be in trouble.

Collateral

In mortgage lending, this is the house itself, and very important. Lenders like traditional homes that are easy to resell if something were to happen, and why getting loans on fixer-uppers, and odd homes, like a berm or log home are more difficult.

Conditions

This one is more about the overall picture, and the purpose of the credit. In mortgage lending, a good example is the difference between an owner occupied home, and a buying a rental property.

The Bottom Line

As you can now see, there is a lot more to getting a home loan than just your credit score, but also how important credit scores are, as well as your overall picture and profile.

If you are thinking of buying or refinancing a home, our experts here at Cambria Mortgage, the Joe Metzler team are happy to provide a no obligation application review, along with a softpull credit report, which has no impact on your credit score.

We lend in MN, IA, ND, SD, and WI

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.