-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, Florida

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Closing Costs

- Loan Programs

- Programs at a Glance

- Buying a House

- Bad Credit Loans

- Commercial / Apartment

- Down Payment Assistance

- Doctor Loans

- First Time Home Buyer

- FHA Loans

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Renovation Loans

- Loans for Self Employed

- USDA Loans

- VA Loans

- Client Resources

- The Home Loan Process

- After BK or Foreclosure

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Checkup

- Blog

- Live Chat

- My Acct

- Mobile App

- Fun Stuff

- Calculator

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Closing Costs

- Loan Programs

- Programs at a Glance

- Buying a House

- Bad Credit Loans

- Commercial / Apartment

- Down Payment Assistance

- Doctor Loans

- First Time Home Buyer

- FHA Loans

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Renovation Loans

- Loans for Self Employed

- USDA Loans

- VA Loans

- Client Resources

- The Home Loan Process

- After BK or Foreclosure

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Checkup

- Blog

- Live Chat

- My Acct

- Mobile App

- Fun Stuff

- Calculator

Just starting? Not ready for a full application? This quick qualify option is here to help narrow down options based on your individual needs.

Ready to fully apply? Our online loan application process is quick, easy, and secure. If you prefer, just call (651) 552-3681.

Lear some tips and tricks on how you can get the best mortgage interest rates and closing costs.

Purchase or refinance, get a free, no obligation, no SSN needed personalized quote of today's rates and closing cost options.

READY TO APPLY? Our Secure Online Mortgage Application is available 24/7. There is no application fee, and we will only move forward with an actual loan your permission after reviewing all your options with you.

WANT JUST A QUICK QUOTE? Complete the Quick Quote Form. This option allows our Licensed Loan Officers the opportunity to research current mortgage interest rates, refinance options and programs, then get back to you with our accurate quote.

Check today's mortgage interest rates based on your personal situation. Get live market mortgage rates and closing cost cost options. Pick what interest rate or closing cost option works best for you.

Pay off those high interest rate max'd out credit cards, with a Cash Out Refinance. Lower your total household monthly payments by hundreds of dollars by combining all your debt into one single mortgage payment.

Home Mortgage Loans in MN, WI, IA, ND, SD, CO, FL, CO, FL

Welcome to Cambria Mortgage, the Joe Metzler team. Joe and his team are committed to helping you make a truly informed mortgage decision. Our advice goes way beyond just quoting rates and fees. We provide you with a complete analysis of your mortgage debt picture through analysis and reports. Most people don't understand the life changing differences between different loan programs, but we want to make sure YOU do.

With our low interest rates and low closing costs, you might be wondering about the kind of service or expertise you'll receive. You're in for a pleasant surprise. We've gone to great lengths to streamline the loan process and make it the easiest, most convenient experience imaginable. No appointment needed. No account numbers or shoe box full of financial papers. Just the information that's in your head.

Find out how good it feels to work with a lender that delivers on both price and service. Read our reviews, then you'll know why we enjoys a 98.0% overall recommendation rating, which we'd like to point out is a far higher standard than mere satisfaction.

I have closed thousands of loans in my career. That's a lot! Those customers contributed to our continuing success because they know WE GOT THEM A BETTER DEAL!

Phone apps, robots, application clerks, and rockets don't care about you or your loan. It would be cool to just push a button and magically get a mortgage loan, but it really doesn't work that way, no matter what the TV commercial shows.

How can you be sure you are getting the best deal? We are in your corner. As the actual lender, home loans are all we do. We beat the banks, the big internet lenders, and the Realtor's in-house lender everyday with our great interest rates on home loans, and personalized service from LOCAL professional Licensed Loan Officers.

Cambria Mortgage pros like Joe Metzler work directly with you to ensure you stay informed and on track throughout the entire performance. We succeed when you succeed. Our ultimate goal is to create lasting relationships by closing your home loan on time with a stress free process.

We can do the same for you! So if you are checking mortgage rates in our backyard of Minneapolis, St Paul, or all of Minnesota, Colorado, Florida, Wisconsin, South Dakota, North Dakota, Iowa, we can help you get the lowest cost mortgage of anyone on your area, saving you thousands of dollars!

TOP REASONS YOU SHOULD HAVE US HELP YOU:

We keep it simple for you! Slick advertising is not our game. We are a top MN lender, and it's not just because of our LOW mortgage rates. Its because we offer the whole package! We provides fully automated digital process, with all of the latest electronic signatures, secure document transfer, and instant approval systems. Plus we even give you instant notification for each step of your loan with our Smartphone app!

Latest Mortgage News

Paying off a collection could hurt your credit score

March 19, 2024Should you pay off collections on your credit report?

Fannie Mae to give $2500 to homebuyers

March 6, 2024Fannie Mae to give $2500 to homebuyers Do YOU Qualify for the Free Money? Minneapolis, MN: Fannie Mae, who buys completed loans from lenders, has announced an addition to it's popular HomeReady program, where eligible low-income homebuyers may qualify for a credit

What Our Clients Say

Joe was very informative, unbelievably knowledgeable in his field! He helped us finance our dream home. I hope to never move again but if I did, I will call Joe! Great guy! I highly recommend!

Joe was very informative, unbelievably knowledgeable in his field! He helped us finance our dream home. I hope to never move again but if I did, I will call Joe! Great guy! I highly recommend!

Beth A (Purchase, Sept 2023) Pine City, MN. ★★ ★ ★ ★

Very satisfied. Everything was so well explained, and both of you are great trouble shooters! I feel that you and Eric were the perfect team to successfully offer us an asset depletion loan. You both are truly experts in your fields!!

Ken M. (Purchase - April 2022) Minneapolis, MN ★★ ★ ★ ★

I highly recommend Joe and Eric, they made the process simple and quick! Joe is highly knowledgeable and can get the job done.

Anita M. (Investment Property Refinance), International Falls, MN ★★ ★ ★ ★

Explore the possibilities

Install the Cambria Mortgage App

With Our FREE Mobile app for iPhone ™ or Android ™ you can do a full loan application, follow the status of your loan, scan and upload documents, calculate potential house payments, and more! You also get direct contact with your Loan Officer, have push notification reminders for important dates (appraisal, closing, rate lock etc.), initiate a chat, and contact information for all involved. Mobile Capture Technology even allows you to scan and securely upload documents, and via our secure portal, you can view, eSign, and download loan documentation (approval, appraisal and closing docs).

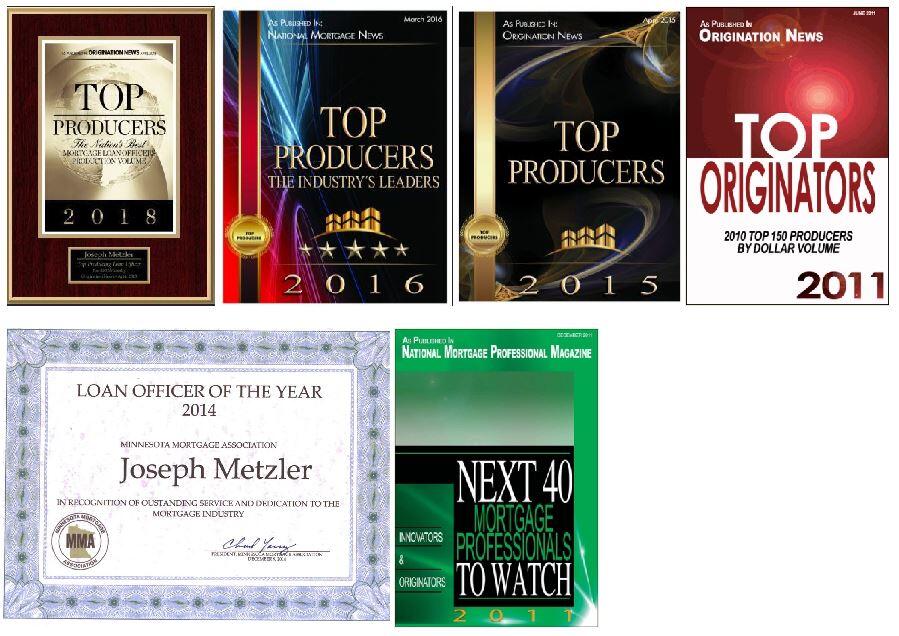

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-4127

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.