-

Why paying off a collection could hurt your credit score

March 19, 2024

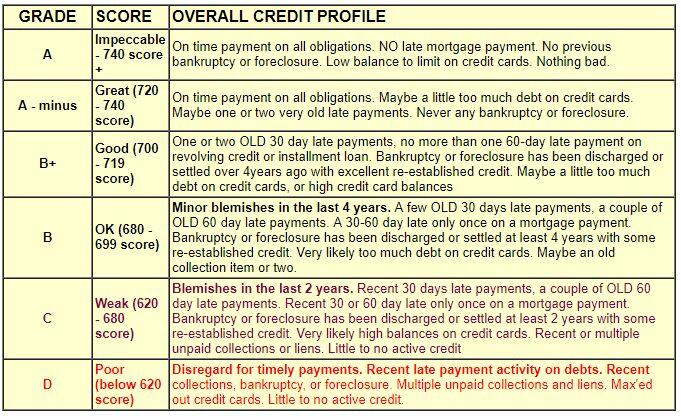

Minneapolis, MN: When looking to buy a home, we all know having good credit scores helps a lot. Both in just the ability to even get a loan, and to get the best possible interest rate on the mortgage.

To that end, many people correctly trying cleaning up anything old and negative on their credit report. I recently had a client reach out to me who a month ago, paid off about a 5-year old small collection on their credit report that was less than $100 expecting that doing so would improve her credit scores.

To her amazement, when I pulled her credit report for her mortgage application, her scores was LOWER! She wondered why paying off a collection HURT her credit score, not helped.

The major issue here is that ANYTIME there is any activity on an account, including a payment, it will update the ‘date of last activity’ or DLA. So in this case, the small, and 5-year old unpaid collection on her credit, which was only hurting her score a little bit because of how old it was, now moved the negative activity date to current, and a current collection, even paid, will easily drop a score 30-points or more.

Worse yet, it also resets the negative information to another 7-years BEFORE it falls off her credit report. Yikes!

What Should You Do About Collections on Your Credit Report?

That depends. A current unpaid collection hurts your credit score a lot. A paid collection hurts less.

The first tip is to reach out to the creditor and do everything you can to totally get it deleted and removed. Many creditors are willing to removing it upon payment. Try that.

If it is a fairly recent collection, which is roughly less than two-years old, you should pay it off.

If it is more than two-years old, and especially if it is 4-yr or more old, in more cases than not, it is probably best to avoid paying off the collection as it will hurt your credit score in the short-term and keep in on your credit report for another full seven years.

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.