-

Think Twice Before Holding Out For Lower Mortgage Rates

Minneapolis, MN: Inflation is hitting everyone every way we turn. The Federal Reserve early in 2022 starting taking steps to attempt to slow down the pace of inflation. Their main tool is to raise the cost of borrowing, which no one likes, but does tend to work.

Coming off of historically low mortgage interest rates, today’s rates seem very high, although in a historical perspective, they are not. January 2022, a typical 30-yr fixed was about 3.00%, by March it was 4.50%, and it peaked at over 7% in Oct 2022. You can click here to see today’s national mortgage interest rate averages.

Mortgage rates have come down already, and inflation is starting to come down. This is great news for homebuyers, as any drop in rates eases the payment or increases your buying power, yet many hopeful buyers are remaining on the sidelines, waiting for them to come down more.

Interest Rate Forecast

It is important to have a realistic expectation of the short-term future of mortgage rates. We are NOT going back to 3% anytime soon, and inflation is NOT going back to 2% anytime soon. The best I’ve seen from the market guru’s in for rates to maybe get slightly lower than today over the next few months, and maybe into the lower 5’s or upper 4’s in mid 2024. Of course no one has the magic crystal ball, but these projections are very realistic.

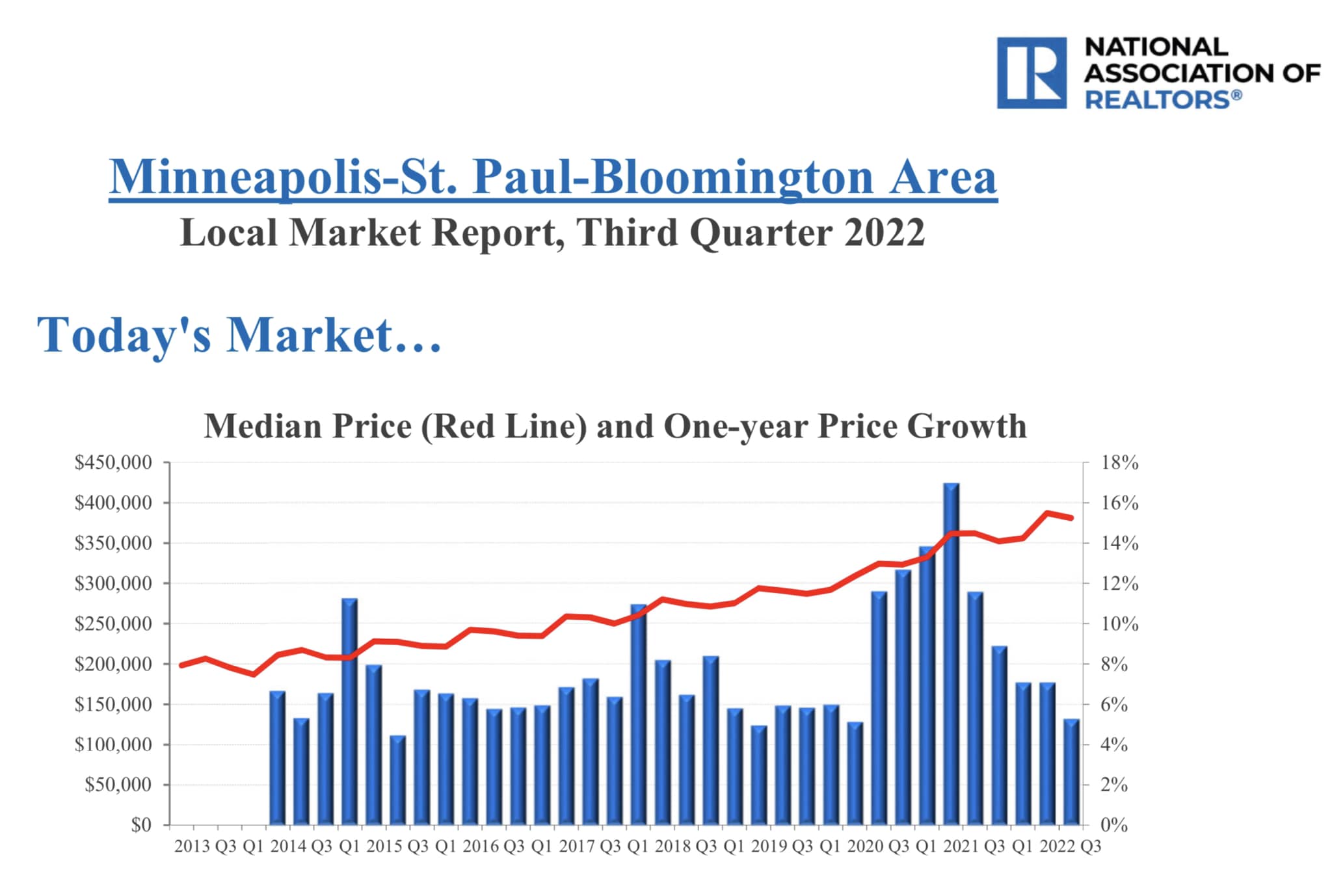

Home Prices

Even with the lower demand for homes because of the higher interest rates, we still have a housing shortage. Home prices continue to go up, although at a slower pace than the past couple of years. You can always refinance any loan you get today when interest rates drop, but you can’t renegotiate the price you paid for the house later. Waiting for a lower interest rate can easily be wiped out by having to pay more for the house, and important equity gains.

Should You Buy Today?

Yes. The old saying is the best time to buy a house was 5-years ago stands true. If you wait today, you’ll be kicking yourself in the future. Waiting for Mortgage rates to come down may cost you more money in the long run than buying now and refinancing later

Ready to Get Started?

We make it easy. Simply call us at (651) 552-3681, or click HERE to APPLY online, or to Schedule and Appointment. We’ll review your credit, income, assets and goals so that you know how much house you can afford. Once we know what you qualify for, we’ll review your pre-approval letter with you and the listing agents to help get your offer accepted sooner.

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

33 Wentworth Ave E, St Paul, MN 55118

Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2024.