-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

- Your mortgage isn’t just another transaction—it’s the foundation of your financial future. Entrusting it to someone who merely quotes rates, without the expertise to guide you or solve complex problems, is a risk you cannot afford. So, how can you be sure you’re working with a true professional—a licensed, experienced advisor who will protect your interests?

Here’s how to spot the difference between a rate clerk and a trusted mortgage expert.

⚠️ Urgent Warning for Minneapolis & St. Paul Homebuyers: How to Choose Your Mortgage Lender in 2025

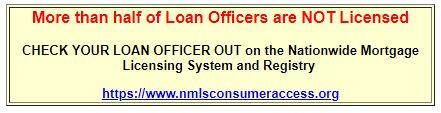

Your mortgage is the largest financial decision you’ll likely ever make. Trusting it to just anyone—especially an unqualified, unlicensed loan officer—could cost you thousands, cause stressful delays, or even derail your home purchase entirely.At Cambria Mortgage, we believe you deserve a true expert guiding you. Here’s how to protect yourself in 2025 and beyond.The Critical Difference: Licensed vs. “Registered” Loan Officers

Most borrowers don’t know this: Not all loan officers are created equal. There is a monumental difference in training, expertise, and legal accountability.While all loan officers have an NMLS number, that number does not mean they are fully licensed. Here’s the inside scoop:-

Licensed Loan Officers (Independent & Non-Bank): Must pass rigorous state and federal testing, complete ongoing education, and are held to the highest ethical and professional standards. This is what you want.

-

“Registered” Loan Officers (Many Big Banks & Credit Unions): Are exempt from these requirements. They often need no significant training, pass no tests, and face lower accountability. They are essentially application clerks.

How to Instantly Check Your Loan Officer’s Credentials:

-

Find their NMLS number on their card, email, or website.

-

Look them up on the official NMLS Consumer Access website.

-

Scroll to the bottom of their profile.

-

Look for the heading:

-

✅ GOOD: “State Licenses/Registrations” = Listing one or more states. They are fully licensed and authorized to do loans only in the states listed.

-

❌ RED FLAG: “Federal Registration” = They are individually unlicensed and only registered. They are authorized to do loan, and their company is still licensed.

-

Why This Puts You at Risk:❌ Unlicensed Loan Officers were never required to take any classes, training, or tests to become a Loan Officer. They also DO NOT have to take yearly continuing CE classes.✅ Licensed Loan Officer had to take classes and pass test to become a Loan Officer. They are also required to take yearly Continuing Education classes (CE) to ensuring they are up to date and current on rules, regulations, and loan options.❌ Unlicensed loan officers at large banks and credit unions often may lack the deep expertise to:-

Navigate complex loan scenarios.

- Fail to advise you with current rules.

-

Advance troubleshoot underwriting issues that arise down the line.

-

Advise you on the best loan program for your long-term financial health.

Many are incentivized to simply take applications, not to provide expert counsel.You Deserve a Licensed Expert on Your Team

Don’t gamble with your financial future. At Cambria Mortgage, every member of our team is fully licensed, highly trained, and committed to ethical, transparent service.Ready to Work with a True Professional? Get the expert guidance you deserve from a locally owned, fully licensed Minneapolis St. Paul mortgage team.Serving Minneapolis, St. Paul, and the Twin Cities with integrity and expertise.-

Loan Officer Test

4 Questions Your Loan Officer MUST Answer Correctly (Or Call The Joe Metzler Team)

Your choice of mortgage professional will make or break your financial future. If your loan officer can’t answer these four essential questions correctly, it’s a major red flag. Stop—do not proceed. Your next call should be to the Joe Metzler Team at Cambria Mortgage.1. What are mortgage interest rates based on?The ONLY correct answer: Mortgage Backed Securities (MBS), not the 10-year Treasury Note. While they sometimes move together, they often diverge drastically.🚨 Why it matters: A lender watching the wrong indicator can’t effectively advise you on timing or strategy.✅ The Joe Metzler Team advantage: We monitor MBS in real-time and explain how market shifts impact your rate—so you never miss an opportunity.2. What’s the next economic event that could move rates?The correct answer: A qualified professional will immediately reference upcoming reports like CPI, jobs data, or Fed announcements.🚨 Why it matters: Economic calendars drive rate volatility. Ignorance here costs you money.✅ The Joe Metzler Team advantage: We provide clients with a clear outlook on high-impact events and what they mean for your lock strategy.3. How do Fed rate changes affect mortgage rates?The correct answer: The Fed Funds Rate influences short-term borrowing (e.g., credit cards, auto loans). Mortgage rates often move opposite to Fed actions due to market expectations and inflation trends.🚨 Why it matters: Misunderstanding this means your loan officer doesn’t grasp macroeconomics—or your loan’s cost drivers.✅ The Joe Metzler Team advantage: We cut through the noise and explain how Fed policy really impacts your long-term mortgage expense.4. What’s happening in the market today—and what’s next?The correct answer: Your loan officer should clearly explain current MBS trends, rate momentum, and near-term forecasts.🚨 Why it matters: If they can’t, they’re an application clerk—not a strategist.✅ The Joe Metzler Team advantage: We provide timely, actionable insights so you can lock with confidence.Still Unsure? Here’s Your #1 Tip:Google your loan officer. Do you see articles, quotes, or signs of industry respect? Or just a bare-bones profile?You deserve an expert—not a clerk.The Joe Metzler Team at Cambria Mortgage is locally respected, nationally recognized, and relentlessly focused on your success.Schedule Your Consultation with the Joe Metzler Team Today

Serving Clients with expertise you can trust.-----

Final Expert Guide from Joe Metzler, Senior Mortgage Loan Officer / Branch Manager

Navigating the mortgage market requires more than just comparing numbers—it demands strategy, expertise, and a trusted advisor. Joe Metzler, a licensed mortgage expert serving CO, FL, IA, MN, ND, SD, and WI, reveals the rules and secrets to shopping effectively for your home loan.Rule 1: If It Seems Too Good to Be True, It IsMortgage funds originate from the same bond market. Lenders follow nearly identical guidelines, and closing costs are largely standardized across the industry. If one lender offers a rate or fee structure drastically better than the rest, you haven’t found a miracle—you’ve found a red flag.Ask these questions immediately:-

Is there a prepayment penalty?

-

Are there hidden fees not disclosed upfront?

-

What is the rate lock period? (Short locks often bait low rates.)

-

Are discounted fees offset by a higher interest rate?

Joe Metzler’s Advice:“When three lenders quote similarly and one stands out as ‘magically’ better, you’ve likely found the biggest liar—not the best deal.”Rule 2: You Get What You Pay ForChoosing the cheapest option means entrusting your largest financial transaction to the lowest bidder. Would you fly on a plane built with the cheapest materials by the cheapest labor? Unlikely.-

Best case: You receive minimal advice, poor service, and generic solutions.

-

Worst case: Your loan fails to close, risking your dream home.

Why Choose Joe Metzler at Cambria Mortgage?We invest in cutting-edge technology, continuous training, and personalized service to ensure a seamless, successful closing. While our rates are highly competitive, we prioritize value—not just price. If you want the absolute cheapest quote, you’ll find it online… but you may pay far more in the long run.Rule 3: Compare Loans CorrectlyMost shoppers misunderstand critical details:-

“No closing cost” loans hide fees in a higher interest rate.

-

Low rates often require paying discount points (increased upfront costs).

-

APR is easily manipulated and is a worthless comparison tool for the uninformed.

Joe Metzler’s Team provides a transparent Total Cost Analysis, breaking down the long-term math of every option so you can compare apples to apples.Rule 4: Rates and Costs Are IntertwinedYou can choose any rate you want—but it comes with trade-offs:-

Lower rate = Higher upfront costs (points/fees).

-

Lower costs = Higher interest rate.

The right balance depends on your financial goals, timeline, and cash flow. A professional advisor like Joe Metzler helps you navigate this balance strategically.Rule 5: Rates Change Hourly—Compare FairlyMortgage rates shift throughout the day based on market volatility. To compare lenders accurately, you must request quotes:-

At the exact same time.

-

For the exact same loan terms.

-

With the same lock period (longer locks often have higher rates).

Your Smartest Move: Consult a Multi-State ExpertYou might secure a mortgage only a few times in your life. Joe Metzler and the Cambria Mortgage team do this every day across seven states: CO, FL, IA, MN, ND, SD, and WI. We combine national market insight with local expertise to guide you to the optimal financial decision.Don’t gamble on your future. Trust an expert.-

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

1549 Livingston Ave, Suite 105

Saint Paul, MN 55118Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2025.