-

Share via:

(651) 552-3681

Home Purchase - Home Refinance

Serving MN WI IA ND SD CO FL

- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

Navigation- Home

- Reviews

- Apply

- Quick Qualify

- Rates & Costs

- Loan Programs

- Bad Credit Loans

- Buying a House

- Commercial / Apartment

- Doctor Loans

- FHA Loans

- Down Payment Assistance

- First Time Home Buyer

- HomeReady

- Investor DSCR Loans

- Luxury home financing

- Jumbo Loans

- Loans for Self Employed

- New Construction Loans

- No Down Payment Loans

- No Doc / Non-QM

- Refinancing

- Contract for Deed Refi

- Renovation Loans

- USDA Loans

- VA Loans

- Client Resources

- After BK or Foreclosure

- The Home Loan Process

- Daily Mortgage News

- Your credit score

- Student loans

- Homebuyer Classes

- Mortgage FAQ

- Glossary of Mortgage Terms

- Use a Bank or Broker?

- Fixed or ARM

- Home Buyers Guide

- Mortgage Rate Locks

- Long Term Rate Locks

- Mortgage Loan Limits

- No Closing Cost Loans

- Get a Second Opinion

- Tips for a smooth closing

- Top Mortgage Mistakes

- Foreclosures / Short Sales

- How to buy foreclosures

- Well and Septic

- Beware Predatory Lenders

- About

- Blog

- My Acct

My unique advantage is that I have been in the mortgage lending, the home loan business well over 25-years. Experience is everything in this industry. As a top 1% Loan Officer in the country for multiple years, I have the experience of all facets of mortgage lending to help you to the closing table.

I can tell you that getting a home loan approved and closed IS CHALLENGING in today's market, and LOW LEVEL application clerks at the big banks and large internet lenders fall very short. You need the right person on your team.

It is more important that ever to get the best interest rate and program for yourself by working with extremely well qualified Loan Officers and Real Estate Agents. You will pay the same rate and closing costs for someone in the business 20-years and someone who got into the business six months ago.

I understand that mortgages are not a one-size-fits-all business, and I take pride in understanding my client's financial scenario and identifying the loan that best suits their needs. I know what happens at each step of the home loan process and why. Your home is the single largest item you will ever finance and the process shouldn’t have to be so hard, confusing, or scary and you shouldn’t have to do it alone.

With an expertise in all aspects of home mortgages, I can cater to both simple and challenging scenarios. I often assume files that others can't figure out how to get approved, primarily due to lack of experience.

Easy or hard, I appreciate the opportunity to assist you in making your home ownership dreams become reality. I am your partner from start to finish. So what sets me apart from everybody else? Communication, Responsiveness, Accuracy, Turnaround and most importantly…….. Close on Time, Every Time!!!"

- Joe Metzler

Experience and Education Matter

Experience and Education Matter with Joe Metzler

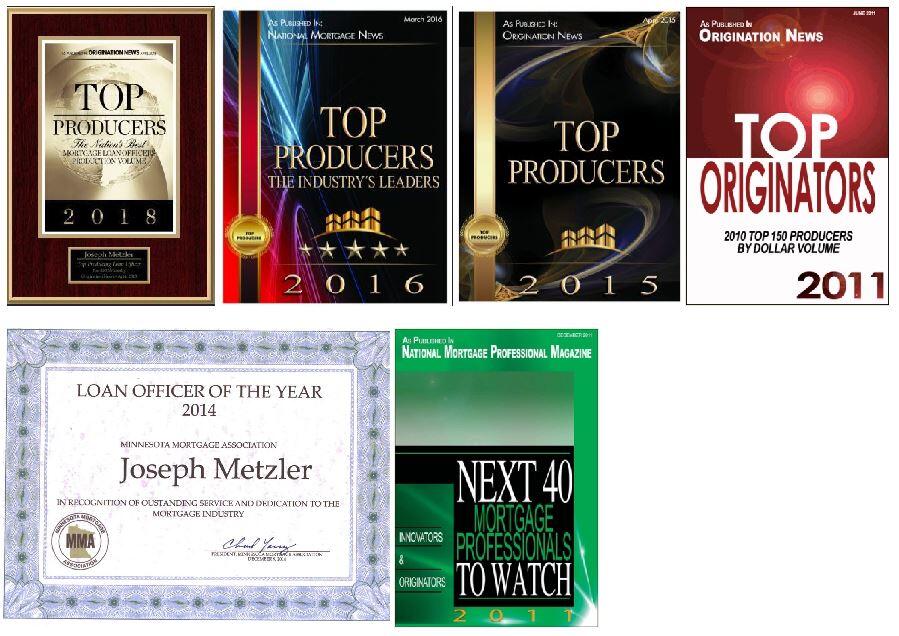

Joe Metzler is a nationally recognized mortgage expert with over 25 years of lending experience. He has personally closed thousands of mortgage transactions, totaling over $500 million in closed loans. Locally, Joe was named the Minnesota Mortgage Association’s coveted State of Minnesota 2014 Loan Officer of the Year and has been recognized nationally with multiple awards as a Top 300 Loan Officer in the nation.

Joe has authored numerous articles on mortgage loans for industry publications and websites, including Bankrate.com. He has also taught classes for Loan Officers, Realtors, and first-time homebuyers. As a mortgage expert, Joe has appeared on multiple radio and TV stations. With each customer’s desires and goals as his top priority, Joe Metzler is ready to assist with all your financing needs.

Joe began his career as a Loan Officer at a small broker shop in the 1990s, then moved to Mortgages Unlimited in 2000. He quickly became a top-rated Loan Officer for nearly 19 years until June 2019, when he joined Cambria Mortgage to better serve his clients.

Why Choose Cambria Mortgage?

Cambria Mortgage is a locally owned and operated mortgage company based in Minnesota, brought to you by the same family that offers industry-leading Cambria Countertops. We are committed to providing all our customers with the highest levels of quality and service. Joe and Cambria Mortgage serve homeowners in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida.

Did You Know?

Did you know around 70% of Loan Officers are not licensed? Yikes. As a licensed mortgage professional, not only will I just take the application and process your file, but I will show you all your different options. You tell me what you really want, and then I will advise you on what I think is best based on your needs and financial goals. I'm proud to provide solutions to each of my customers, no matter what their financing needs!

Joe's Personal Awards and Recognition's

- 2024 Mortgage Broker of the Year (National Association of Mortgage Brokers (NAMB)

- 2023, 2022, 2021, 2020, 2019, 2018 - Super Mortgage Professionals™ (Twin Cities Business Magazine)

- 2024, 2023, 2022, 2021, 2020 - Best Mortgage Company in St Paul, MN

- 2018 - Top 300 Loan Officer in the nation (National Mortgage News)

- 2016 - Top 300 Loan Officer in the Nation (National Mortgage News)

- 2015 - Top 100 Loan Officer in the Nation (National Mortgage News)

- 2014 - Minnesota Loan Officer of the Year (Minnesota Mortgage Association)

- 2011 - 40 Most Influential Mortgage Professionals to Watch (NMPM)

- 2010 - Top 150 Loan Officer in the Nation based on Dollar Volume (Origination News)

Experience No Surprises at Closing with the Metzler Team

When you finance through the Metzler Team, you can expect no surprises at closing. We provide prequalification advice, ongoing assistance, and follow-up support. Our team collaborates with real estate agents, builders, title companies, appraisers, and homebuyers to ensure a smooth and stress-free experience. Our reputation for dependability, honesty, and consistent performance speaks for itself.

Meet Joe, Your Minnesota Mortgage Specialist (MMS)

Joe is one of fewer than 100 professionals in Minnesota who have earned the prestigious Minnesota Mortgage Specialist (MMS) designation. This title, awarded by the Minnesota Association of Mortgage Brokers, Inc. (MAMB), distinguishes experienced, well-educated, and ethical mortgage professionals. To achieve this designation, Joe completed rigorous educational and professional requirements, including attending the Minnesota Mortgage Lending School, taking Mortgage Law and Ethics classes, and passing the MMS test. He also participates in annual continuing education to stay current with industry laws and ethics.

A Lifelong Twin Cities Resident and Mortgage Expert

Joe, a lifelong resident of the Twin Cities, graduated from the Residential Mortgage Lending School in 1998, well before the mandatory licensing rules for non-bank Loan Officers were established in 2011. His voluntary commitment to education and excellence sets him apart in the industry.

Unmatched Professionalism and Service

In an industry with numerous competing lenders and mortgage programs, Joe’s consistent professionalism and thorough service make him stand out. He has successfully helped Realtors and Builders close many transactions and is known for his knowledge and dedication. Joe believes in doing the job right the first time and has solutions for even the most complicated situations. He is committed to people, community, and homeownership.

Outstanding Service You Can Depend On

Joe and his team are dedicated to providing outstanding service, whether you are buying your first home, your dream home, refinancing, or seeking a debt consolidation loan. Call Joe today for all your mortgage financing needs.

Meet Joe and Experience Excellence

Once you meet Joe, you’ll understand why he is a highly rated mortgage expert. His exceptional track record, confidence, organization, friendliness, and helpfulness make him a standout professional.

My Commitment as Your Loan Officer

- I will return phone calls promptly.

- I will keep all parties informed, every step of the way.

- I will endeavor to resolving problems quickly.

- I will following through on each transaction right through to moving day.

- I will endeavor to act in the best interests of the customer at all times.

- I will establish a price for services upfront, in writing, based on information provided by the customer (Loan Estimate), so that there are no surprises.

- The price or prices will cover all the services provided by us.

- On third party services, such as an appraisal, ordered by us, but paid for by the customer, I will provide the invoice from the third party service provider at the customer’s request. Alternatively, I may have the payment made directly by the customer to the third party service provider (example: you pay the appraiser when he is at your home).

- I will endeavor to make my Loan Estimate as accurate as possible (unlike the "sunshine lenders", who quote rates & closing costs which are unrealistic, in order to get your business - then surprise you later).

- I will use my best efforts to determine the loan type, features, and lender services that best meet the customer's needs, and to find the best wholesale price for that loan.

- When directed by the customer, I will lock the terms (rate, points, and other major features) of the loan, and will provide a copy of the written confirmation of the rate lock.

- If a customer elects to float the rate/points, we will provide the customer the best rate available to that customer on the day the loan is finally locked.

** EXPERIENCE MATTERS **

Top rated mortgage lender locally and nationally, year after year... This is because clients agree - Experienced Loan Officers with mortgage interest rates you can brag about and amazing service clearly sets us apart from the big banks and online lenders.

Address

1549 Livingston Ave, Suite 105

Saint Paul, MN 55118Contact

Main (651) 552-3681

Joe@JoeMetzler.com

Cell/Text (651) 705-6261We also call from

(651) 615-7545

(952) 486-6135License Info

Cambria Mortgage

NMLS# 322798 Branch:1888858Joe Metzler Loan Officer

NMLS# 274132. License MN #MLO-274132, WI #11418. SD #MLO.03095, ND #NDMLO274132, IA #36175, FL #LO119389, CO #100536785Privacy Policies | Disclaimers | Disclosures | Terms of Use | DMCA Notice | ADA Notice |

Equal Housing Lender. The Joe Metzler Team at Cambria Mortgage lends in Minnesota, Wisconsin, Iowa, North Dakota, South Dakota, Colorado, and Florida only. This is not an offer to lend or to extend credit, nor is this a guaranty of loan approval or commitment to lend. Information here can become out of date, and may no longer be accurate. Products and interest rates are subject to change at any time due to changing market conditions. Not all programs available in all states. Actual rates available to you may vary based upon a number of factors. Consumers must independently verify the accuracy and currency of available mortgage programs. All loan approvals are subject to the borrower(s) satisfying all underwriting guidelines and loan approval conditions and providing an acceptable property, appraisal and title report. Joe Metzler, NMLS 274132, Cambria Mortgage NMLS 322798. © 1998 - 2026.